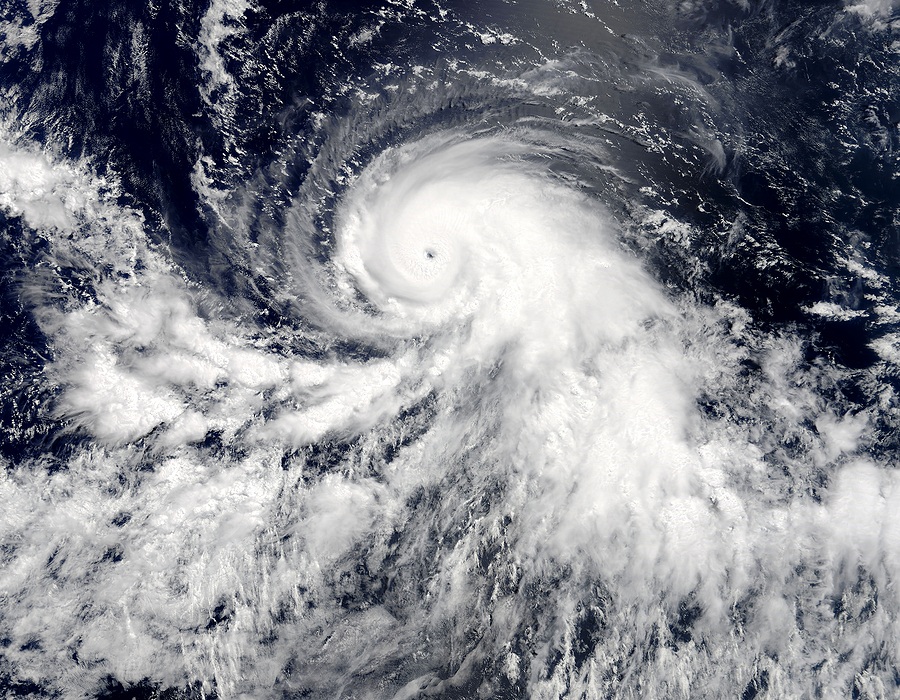

Summer in Connecticut brings warm weather and outdoor fun—but also severe thunderstorms, heavy rains, and even the occasional tropical storm. These events can leave behind costly damage to homes and vehicles. Now is the time to make sure your insurance coverage is ready before the next storm rolls through.

Home Insurance Essentials

Connecticut homeowners know the risks: fallen trees, flooded basements, and roof damage from strong winds. Standard homeowners insurance generally covers wind damage and fallen tree removal if it damages your home. However, flood damage is usually not included—you’ll need separate flood insurance if you live in areas prone to flooding, such as along the Connecticut River or near the shoreline in towns like East Haven or Old Lyme.

It’s also a good idea to review your policy limits. Rising repair costs mean your current coverage may not be enough to rebuild or replace your home after a major storm.

Auto Insurance Essentials

Storm damage doesn’t just affect homes—vehicles are also at risk. Hail, flooding, and falling debris can lead to costly repairs. Comprehensive auto insurance covers these weather-related events, but if you only carry liability coverage, your vehicle may not be protected. Before storm season peaks, ask your insurance agent whether comprehensive coverage makes sense for you.

Preventive Steps to Protect Your Property

In addition to checking your policies, taking preventive measures can reduce your risk:

- Trim overhanging tree branches around your home.

- Clean gutters and drains to prevent water backup.

- Park vehicles in garages or away from large trees if a storm is predicted.

- Keep an updated home inventory for smoother claims processing.

Stay Protected with Petruzelo Insurance

Storms are a fact of life in Connecticut—but financial hardship doesn’t have to be. By reviewing your homeowners and auto insurance policies now, you can ensure peace of mind when the next summer storm arrives. Petruzelo Insurance is here to help Connecticut families stay prepared with personalized coverage and local expertise.