If you live in Connecticut, then you’ve probably received letters from various companies warning you that if your service line breaks, you’ll have to pay for it out of pocket. To prevent this potential financial burden, every one of these warning letters comes with a solution: service line insurance.

The question is: is service line coverage really necessary, or is it just a scam?

To be clear: service line coverage is not a scam. If you’ve heard otherwise, then the information is likely coming from someone who is merely misinformed.

Today we’ll explain what service line coverage is, and why all homeowners should invest in a policy.

What Does Service Line Insurance Cover?

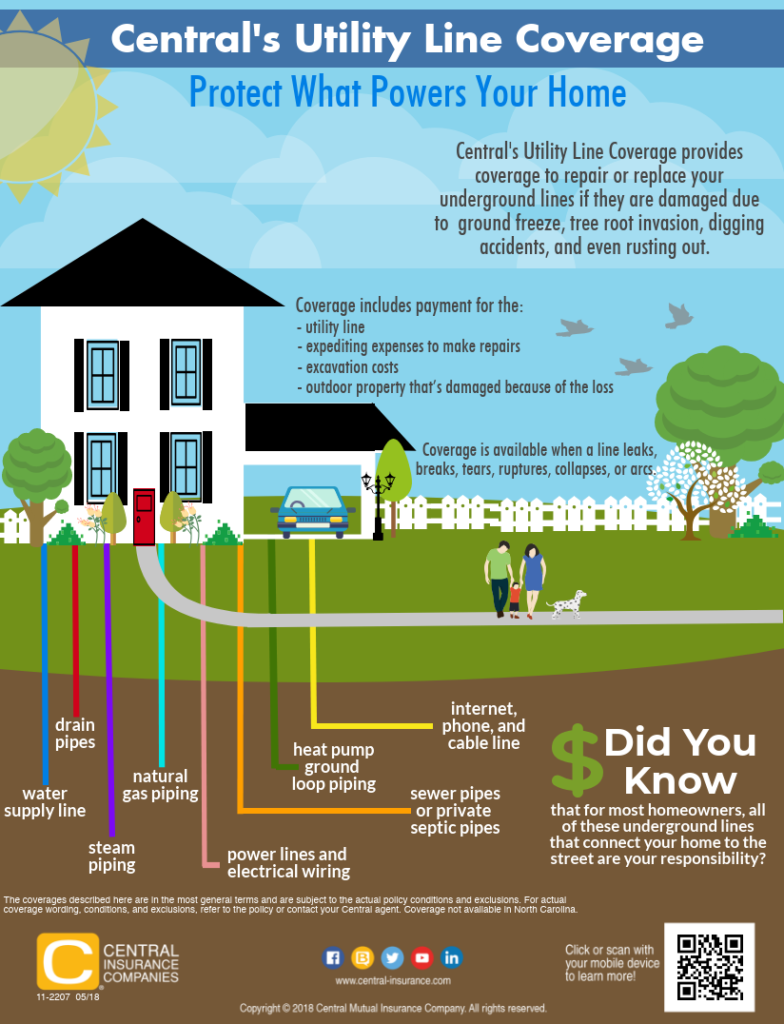

Service line insurance covers the cost to repair or replace utility lines that run from the main point of connection to the main service line up to the dwelling.

Now you might be thinking: if my utility line breaks, can’t I just tell the utility company to come out and fix it?

No, and here’s why.

Most homeowners know who their utility providers are. If you live in Connecticut, then you may get water from Aquarion, power from UI, gas from Southern Connecticut Gas, and cable from Optimum.

What many people don’t realize, though, is that homeowners own the portion of the utility line that runs from the main connection to their dwelling.

These lines are called service lines, and if they break, utility companies are not responsible for fixing them; on the contrary, depending on the severity of the break, utility companies reserve the right to shut off your service until you get it repaired.

For a visual representation, check out this infographic from our friends over at Central

If, for example, a large stream of water begins to engulf your front yard, then there’s a good chance that you have a service line leak.

If the break is severe enough, the water company will mandate that you fix it within 1 – 2 weeks. If you don’t fix it within the timeframe that they set, they will typically shut it off.

Why? Because even though you own the service line, a severe break can deplete the system that your neighbors draw their water from.

Fixing or replacing a broken service line isn’t usually a small task. In order to repair or replace it, the line must be dug up; and when the job is done, you’ll generally receive a bill for thousands of dollars!

Of course, the next logical question is: what causes service lines to actually break?

Service Lines Break Because of…

- Wear and Tear

- Rust and Corrosion

- Mechanical Breakdown

- Freezing or Frost Heave

- Tree or Other Root Invasions

What Service Line Insurance Doesn’t Cover

It’s important to remember that service line insurance only covers the lines when they break. Contrary to popular belief, service line insurance does not cover maintenance. For example, if your water or sewer line freezes, your service line policy will not cover the cost to have a plumber unthaw it; however, you will be covered if it breaks as a repercussion of being frozen.

Now that you understand what service line insurance covers, and why it’s important to have it, you may be wondering:

Isn’t this covered by my homeowners insurance policy?

Service Lines Are Not Usually Covered By Homeowners Insurance

While your service line may be covered under your specific policy, in most cases it’s not. That said, be sure to check your homeowners policy before purchasing a separate policy for your service lines.

Interested in Service Line Insurance? Call Petruzelo!

If you’re interested in getting a homeowners insurance quote that includes service line coverage, then please give us a call. We want you to be fully protected in the event of an unexpected service line break. Don’t wait until it’s too late–contact us today!